How much VA Loan can you get?

Direct from the VA Site as of Summer/2023:

Eligible Veterans, service members, and survivors with full entitlement no longer have limits on loans over $144,000. This means you won’t have to pay a down payment, and we guarantee to your lender that if you default on a loan that’s over $144,000, we’ll pay them up to 25% of the loan amount.

You have full entitlement if you meet any of these requirements.

At least one of these must be true:

Direct from the VA Site as of Summer/2023:

Eligible Veterans, service members, and survivors with full entitlement no longer have limits on loans over $144,000. This means you won’t have to pay a down payment, and we guarantee to your lender that if you default on a loan that’s over $144,000, we’ll pay them up to 25% of the loan amount.

You have full entitlement if you meet any of these requirements.

At least one of these must be true:

- You’ve never used your home loan benefit, or

- You’ve paid a previous VA loan in full and sold the property (in this case, you’d have your full entitlement restored), or

- You’ve used your home loan benefit, but had a foreclosure or compromise claim (also called a short sale) and repaid us in full

Veteran's Resources in the Vegas Valley

(Valley Medical Services, etc.)

From the VA website:

You must have satisfactory credit, sufficient income, and a valid Certificate of Eligibility (COE) to be eligible for a VA-guaranteed home loan. The home must be for your own personal occupancy. The eligibility requirements to obtain a COE are listed below for Servicemembers and Veterans, spouses, and other eligible beneficiaries.

VA home loans can be used to:

You must have satisfactory credit, sufficient income, and a valid Certificate of Eligibility (COE) to be eligible for a VA-guaranteed home loan. The home must be for your own personal occupancy. The eligibility requirements to obtain a COE are listed below for Servicemembers and Veterans, spouses, and other eligible beneficiaries.

VA home loans can be used to:

- Buy a home, a condominium unit in a VA-approved project

- Build a home

- Simultaneously purchase and improve a home

- Improve a home by installing energy-related features or making energy efficient improvements

- Buy a manufactured home and/or lot

- To refinance an existing VA-guaranteed or direct loan for the purpose of a lower interest rate

- To refinance an existing mortgage loan or other indebtedness secured by a lien of record on a residence owned and occupied by the veteran as a home

Dates of Service for Eligibility:

Service during Wartime:

World War II - September 16, 1940 - July 25, 1947

Korean War - June 27, 1950 - January 31, 1955

Vietnam War - August 5, 1964 - May 7, 1975

Service Requirements:

- At least 90 days active duty - with other than dishonorable discharge

- Less than 90 days active duty - if discharged for a service-connected disability

Gulf War - August 2, 1990 - to be determined

Service Requirements:

- 24 months continuous active-duty - with other than dishonorable discharge

- At least 90 days or completed the full term that he or she was ordered to active duty with other than dishonorable discharge

- At least 90 days active duty - and discharged for hardship, early out, convenience of the Government, reduction in force, condition interfered with duty or compensable service-connected disability

- Less than 90 days active duty - if discharged for a service-connected disability

Service during Peacetime:

All - July 26, 1947 - June 26, 1950 and February 1, 1955 - August 4, 1964

Enlisted - May 8, 1975 - September 7, 1980

Officers - May 8, 1975 - October 16, 1981

Service Requirements:

- At least 181* days continuous active duty - with other than dishonorable discharge

- Less than 181 days active duty - if discharged for a service-connected disability

Enlisted - September 7, 1980 - August 1, 1990

Officers - October 17, 1981 - August 1, 1990

Service Requirements:

- You meet the minimum active-duty service requirement if you served for:

- At least 24 continuous months, or

- The full period (at least 181 days) for which you were called to active duty, or

- At least 181 days if you were discharged for a hardship, or a reduction in force, or

- Less than 181 days if you were discharged for a service-connected disability

Between August 2, 1990 and the present

Service Requirements:

- You meet the minimum active-duty service requirement if you served for:

- At least 24 continuous months, or

- The full period (at least 181 days) for which you were called to active duty, or

- At least 181 days if you were discharged for a hardship, or a reduction in force, or

- Less than 181 days if you were discharged for a service-connected disability

There are several unique things that make a Veteran's Home Loan different and worth pursuing:

No Down Payment: This may be the most valuable benefit in any subsidized loan program. Conventional and even FHA loans require money down. Even a 3.5 percent down payment on a $300,000 house would equal $10,500.

Relaxed Requirements: Compared to a conventional loan, a VA loan’s credit requirements, which we discussed above, let more applicants through the door.

No PMI: Most loans, including FHA loans, require borrowers to pay private mortgage insurance which protects the lender if you default. With VA backing, a borrower doesn’t need to pay PMI premiums.

Flexible Payback: Unlike most mortgages, a VA loan allows the borrower to pay back the loan in a variety of ways including a graduated structure which has lower payments at the beginning of the term.

Lower Interest Rates: With so many variables we can’t quote reliable interest rates here, but VA loans typically offer rates lower than conventional loans and FHA loans. A lower rate can save you thousands of dollars over the life of a 30-year fixed rate mortgage.

No Down Payment: This may be the most valuable benefit in any subsidized loan program. Conventional and even FHA loans require money down. Even a 3.5 percent down payment on a $300,000 house would equal $10,500.

Relaxed Requirements: Compared to a conventional loan, a VA loan’s credit requirements, which we discussed above, let more applicants through the door.

No PMI: Most loans, including FHA loans, require borrowers to pay private mortgage insurance which protects the lender if you default. With VA backing, a borrower doesn’t need to pay PMI premiums.

Flexible Payback: Unlike most mortgages, a VA loan allows the borrower to pay back the loan in a variety of ways including a graduated structure which has lower payments at the beginning of the term.

Lower Interest Rates: With so many variables we can’t quote reliable interest rates here, but VA loans typically offer rates lower than conventional loans and FHA loans. A lower rate can save you thousands of dollars over the life of a 30-year fixed rate mortgage.

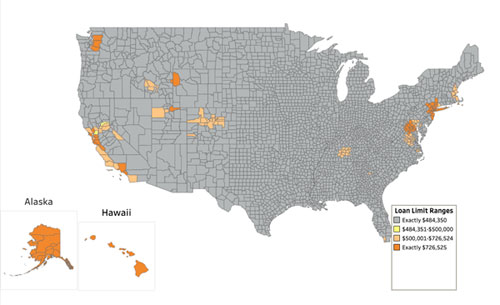

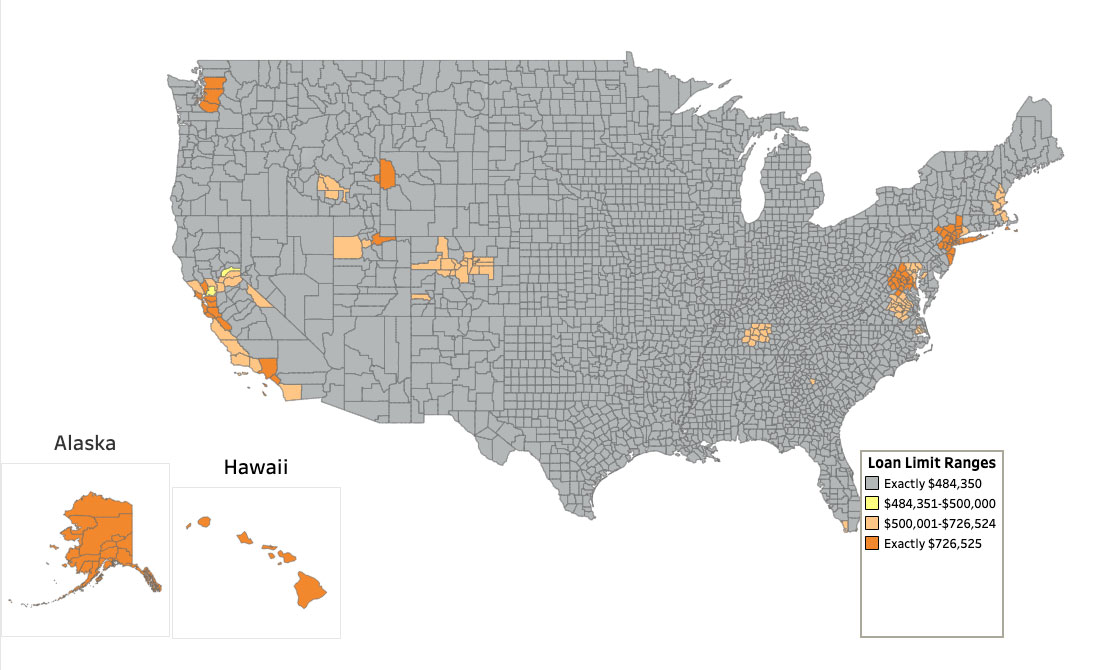

US map of VA Loan Limit Amounts: